Optimal Capital Structure: Is It Achievable?

Optimal Capital Structure: Is It Achievable?

Financial managers seek to maximize organizational value by optimally managing the company’s financial resources. To achieve this, they analyze the capital structure that will deliver the greatest benefits for shareholders and maximize their wealth. This process involves evaluating financing sources, debt issuance policies, share issuance, and leverage decisions, among other factors.

Court E. (2012) in his book Corporate Finance, wrote: “The structure of a company's capital is a mix of debt, equity, and other financing instruments, and the key issue is how to determine a capital structure for the company, given that its objective is to maximize the wealth of its shareholders. In this type of capital structure decisions, the unit of analysis is the company as a whole.” (p. 307).

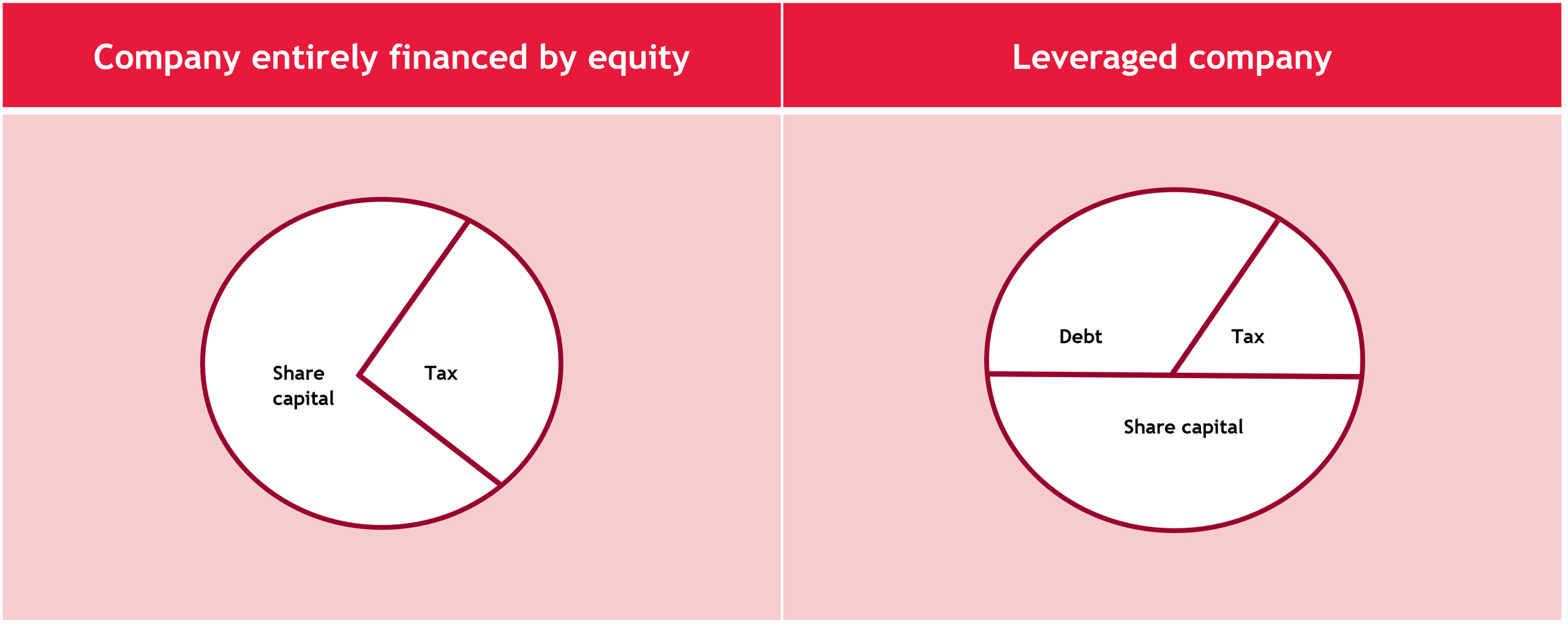

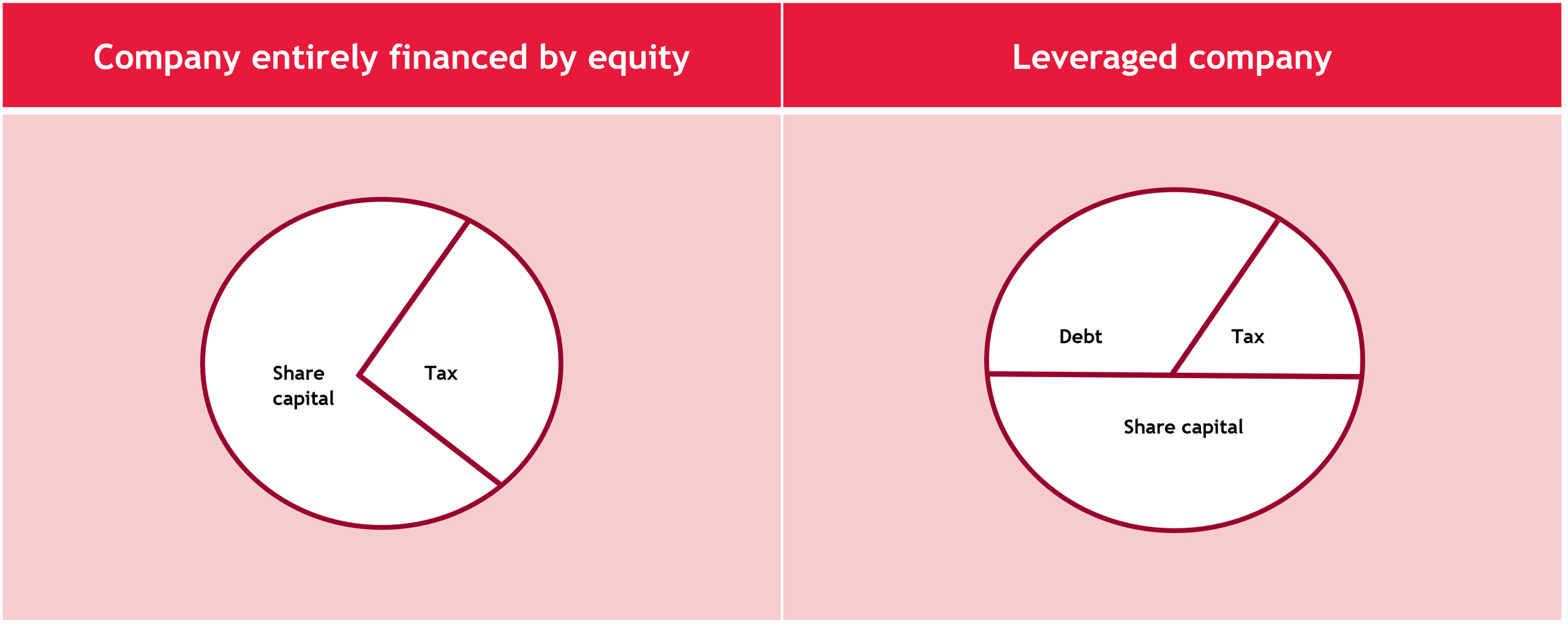

Ross, Westerfield & Jaffe (2012) depicted the value of the firm as a pie chart, which is divided into shares, the company’s equity, and bonds that represent the firm’s issued debt. They also state that the value of the firm is represented by the sum of the market value of its debt and the market value of its equity, given that the firm’s cash flows belong in part to both creditors and shareholders.

Mascareñas J. (2008), in his article The Optimal Capital Structure, wrote:

“This leads us to an important question: are there weightings that minimize the value of the weighted average cost of capital? Because if such weightings exist, we will have found a combination of long-term financial sources such that by minimizing the company’s cost of capital, we will also be maximizing its market value — which, let us not forget, is the main objective of every company director. This combination of long-term financial sources is referred to as the optimal capital structure.” (p. 3).

Like Mascareñas, other authors have written articles about this interesting topic, with their main focus being on maximizing value by reducing the cost of capital. However, this also raises further questions: Has any company actually achieved an optimal structure? Have there been studies in specific sectors or companies where an optimal model has been found? Or is this subject simply confined to finance textbooks and academic lectures based on hypothetical assumptions that are difficult to implement in practice?

It must be noted that leverage leads to lower tax payments compared to a company that is fully equity-financed. One of the key responsibilities of financial managers is to leverage the company up to the point where the tax shield from interest does not negatively impact the company's value and does not benefit the tax authority.

This scenario is illustrated in Figure 1.

.png?lang=en-GB) Figure 1. Two pie models of capital structure with the presence of corporate taxes.

Figure 1. Two pie models of capital structure with the presence of corporate taxes.

The financial management of a company should not rely solely on theory, or financial standpoints or doctrines. Each company operates in a particular context, even when compared to others within the same industry. The pursuit of an optimal capital structure may be closely scrutinized—and even challenged—by another specialist analyzing the same company.

Other personalities in the financial world take a more aggressive stance, asserting that companies should not waste money nor financial managers their time seeking an appropriate capital structure, since such a structure does not exist. However, this article does not subscribe to such an extreme position.

The most advisable capital structure is the one that creates the greatest value for shareholders, reduces the costs of capital, and fosters a risk environment that is favorable to both creditors and society. To achieve this, financial managers must find the right balance between debt and equity, considering the impact of the tax shield.

References

Ross S., Westerfield, R., & Jaffe, J. (2012). Corporate Finance (9th ed.). México, México: McGraw-Hill, pp. 408-502.

Court, E. (2012). Corporate Finance (9th ed.). Buenos Aires, Argentina: Cengage Learning, p. 307.

Dumrauf, G. (2003). Corporate Finance: A Latin American Perspective (3rd ed.). Buenos Aires, Argentina: Alfaomega, p. 426.

Mascareñas, J. (2008). The Optimal Capital Structure. Retrieved from: http://pendientedemigracion.ucm.es/info/jmas/mon/17.pdf

What is Capital Structure?

Capital structure refers to the long-term financing source for a company’s assets or the choice of how the company finances itself. In that sense, the key question is: What is the optimal structure? The widely accepted answer is the one that minimizes the company’s cost of capital; i.e., the cost of the resources it uses to operate.Court E. (2012) in his book Corporate Finance, wrote: “The structure of a company's capital is a mix of debt, equity, and other financing instruments, and the key issue is how to determine a capital structure for the company, given that its objective is to maximize the wealth of its shareholders. In this type of capital structure decisions, the unit of analysis is the company as a whole.” (p. 307).

The Pie Theory and Firm Value

When the cost of capital is reduced, the value of the firm is maximized, since the cash flows generated by the firm are discounted at a lower rate, resulting in a higher net present value. For this reason, various academic texts analyze the value of the firm and associate it with the “pie theory”. Ross, Westerfield & Jaffe (2012), in their book Corporate Finance, wrote: “How should a firm choose its debt-to-equity ratio? This approach to addressing the issue of capital structure is known as the pie model. The pie in question is the sum of the firm’s financial claims, debt and equity in this case.” (p. 408).Ross, Westerfield & Jaffe (2012) depicted the value of the firm as a pie chart, which is divided into shares, the company’s equity, and bonds that represent the firm’s issued debt. They also state that the value of the firm is represented by the sum of the market value of its debt and the market value of its equity, given that the firm’s cash flows belong in part to both creditors and shareholders.

Is There an Optimal Capital Structure?

Many financial managers wonder whether there is a capital structure model that can be applied to all companies, raising questions such as: Does the way a company is financed affect its value? What is the optimal combination of debt and own resources that maximizes the company’s value? Ultimately, they conclude that it is not possible to determine a perfect or optimal model of capital structure.Mascareñas J. (2008), in his article The Optimal Capital Structure, wrote:

“This leads us to an important question: are there weightings that minimize the value of the weighted average cost of capital? Because if such weightings exist, we will have found a combination of long-term financial sources such that by minimizing the company’s cost of capital, we will also be maximizing its market value — which, let us not forget, is the main objective of every company director. This combination of long-term financial sources is referred to as the optimal capital structure.” (p. 3).

Like Mascareñas, other authors have written articles about this interesting topic, with their main focus being on maximizing value by reducing the cost of capital. However, this also raises further questions: Has any company actually achieved an optimal structure? Have there been studies in specific sectors or companies where an optimal model has been found? Or is this subject simply confined to finance textbooks and academic lectures based on hypothetical assumptions that are difficult to implement in practice?

The Tax Advantage of Leverage

At present, all countries operate within a tax regulatory framework, and the most significant and most commonly collected tax is the income tax, which is levied on business profits. The average corporate tax rate ranges from 30% to 35% of earnings before taxes. As a result, companies benefit from the tax shield created by interest payments, as these are deductible from income taxes. Consequently, a company that chooses to take on debt creates greater value for its shareholders. One of the most well-known cases in finance literature is the repurchase of shares, generating debt through the issuance of bonds.It must be noted that leverage leads to lower tax payments compared to a company that is fully equity-financed. One of the key responsibilities of financial managers is to leverage the company up to the point where the tax shield from interest does not negatively impact the company's value and does not benefit the tax authority.

This scenario is illustrated in Figure 1.

.png?lang=en-GB) Figure 1. Two pie models of capital structure with the presence of corporate taxes.

Figure 1. Two pie models of capital structure with the presence of corporate taxes.

Limitations and Business Realities

The financial management of a company should not rely solely on theory, or financial standpoints or doctrines. Each company operates in a particular context, even when compared to others within the same industry. The pursuit of an optimal capital structure may be closely scrutinized—and even challenged—by another specialist analyzing the same company. Other personalities in the financial world take a more aggressive stance, asserting that companies should not waste money nor financial managers their time seeking an appropriate capital structure, since such a structure does not exist. However, this article does not subscribe to such an extreme position.

The most advisable capital structure is the one that creates the greatest value for shareholders, reduces the costs of capital, and fosters a risk environment that is favorable to both creditors and society. To achieve this, financial managers must find the right balance between debt and equity, considering the impact of the tax shield.

References

Ross S., Westerfield, R., & Jaffe, J. (2012). Corporate Finance (9th ed.). México, México: McGraw-Hill, pp. 408-502.

Court, E. (2012). Corporate Finance (9th ed.). Buenos Aires, Argentina: Cengage Learning, p. 307.

Dumrauf, G. (2003). Corporate Finance: A Latin American Perspective (3rd ed.). Buenos Aires, Argentina: Alfaomega, p. 426.

Mascareñas, J. (2008). The Optimal Capital Structure. Retrieved from: http://pendientedemigracion.ucm.es/info/jmas/mon/17.pdf

Contact Us

- Marcela Priori, BSO Partner - Email: mpriori@bdo.com.pe

- Juan Bautista, BSO Accountant - Email: mbautista@bdo.com.pe

- BSO Commercial - Email: atencioncomercial@bdo.com.pe