ERP implementation from an accounting perspective

ERP implementation from an accounting perspective

Deciding to implement an ERP (Enterprise Resource Planning) system is one of the most important decisions a company can make. It is not only about adopting new technology; it is about completely transforming how the accounting, finance, logistics, operations, and production departments are managed.

In Peru, this process must meet specific requirements that cannot be overlooked: there are specific tax, accounting, and financial regulations that must be complied with from the outset. Ignoring them can result in wasted time and financial resources, and in most cases, it may lead to penalties, or may require redoing all the work entirely.

It is often assumed that engaging an ERP provider means that they will take care of everything. However, in practice, many of these providers focus solely on the technical implementation of the system and overlook key aspects of the Peruvian regulatory environment.

That is why, for an ERP implementation to be truly successful, it is essential to involve professionals possessing in-depth knowledge of accounting and tax operations. Only then can the system not only function properly, but also comply with the requirements set out by the National Superintendency of Tax Administration (SUNAT) and accurately reflect the company’s financial reality.

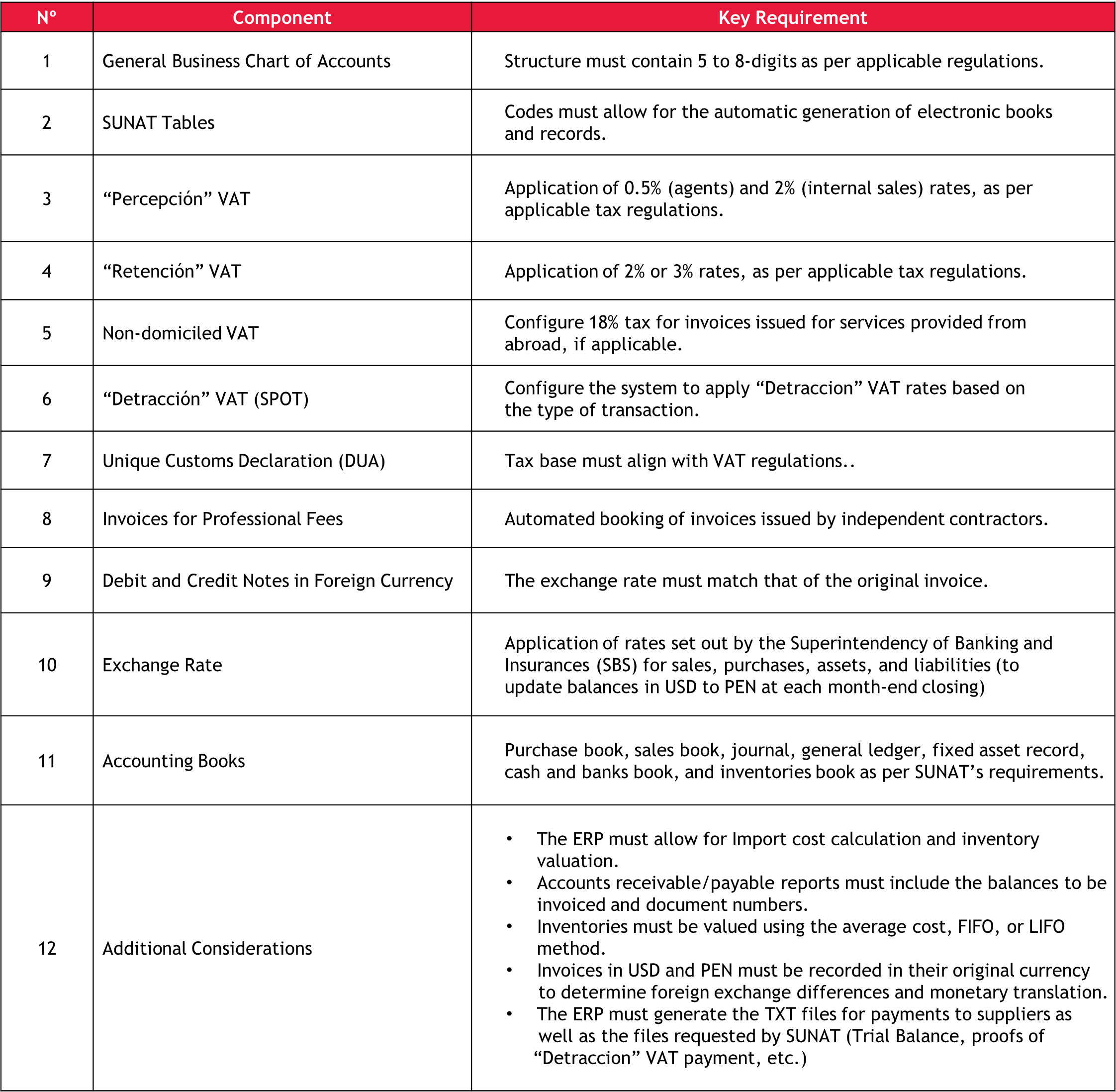

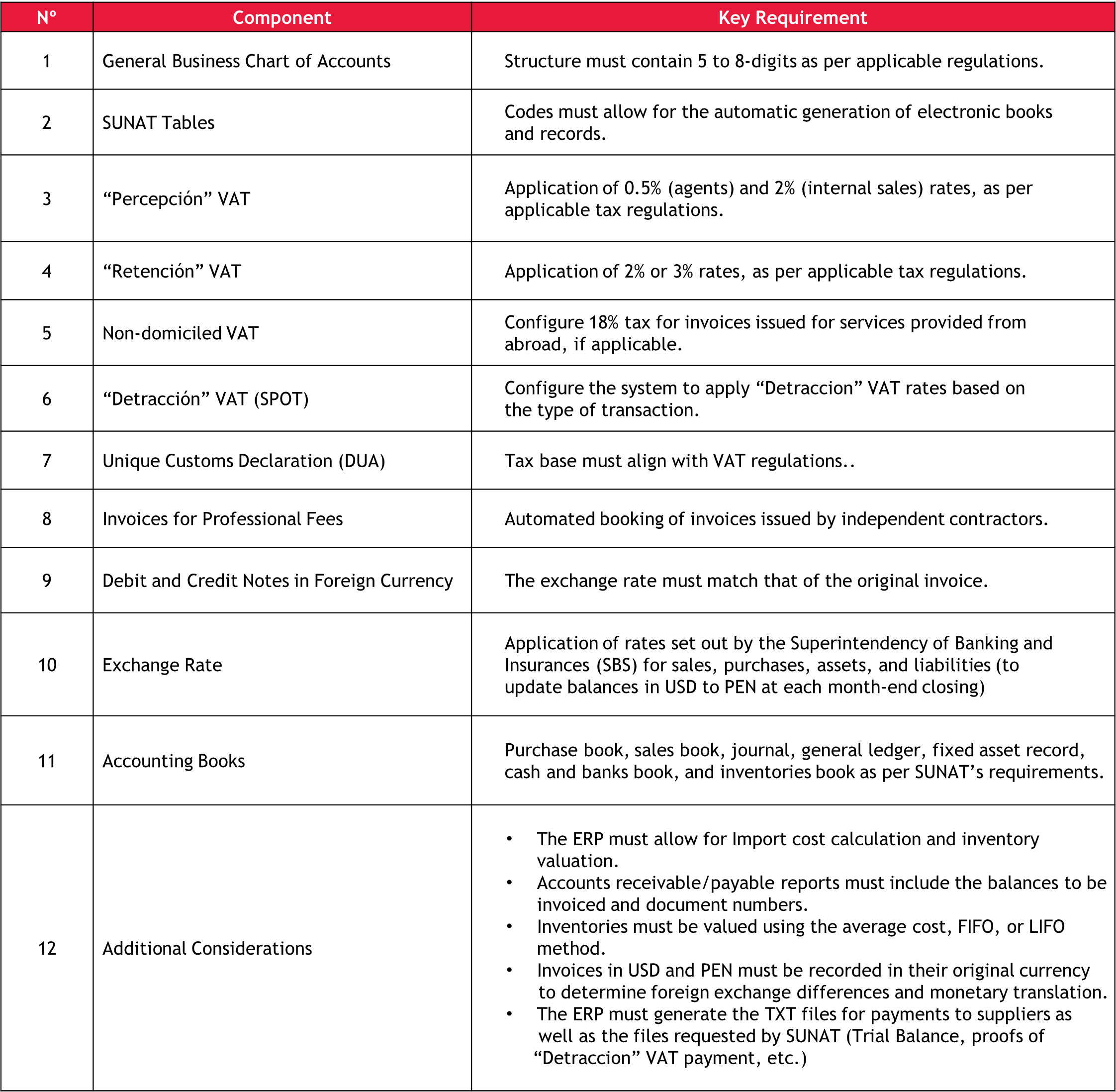

Below are the most important elements to consider when implementing an ERP system in Peru:

In Peru, this process must meet specific requirements that cannot be overlooked: there are specific tax, accounting, and financial regulations that must be complied with from the outset. Ignoring them can result in wasted time and financial resources, and in most cases, it may lead to penalties, or may require redoing all the work entirely.

It is often assumed that engaging an ERP provider means that they will take care of everything. However, in practice, many of these providers focus solely on the technical implementation of the system and overlook key aspects of the Peruvian regulatory environment.

That is why, for an ERP implementation to be truly successful, it is essential to involve professionals possessing in-depth knowledge of accounting and tax operations. Only then can the system not only function properly, but also comply with the requirements set out by the National Superintendency of Tax Administration (SUNAT) and accurately reflect the company’s financial reality.

Below are the most important elements to consider when implementing an ERP system in Peru:

BDO Can Support You in This Process

At BDO, we know that implementing an ERP is not just about technology, it is about understanding how your business works and how to ensure full regulatory compliance from day one. For such purpose, we offer a specialized service that supports you throughout the entire implementation process, leveraging our accounting, tax, and financial expertise.

Our team works hand-in-hand with your technology provider to ensure that each configuration is done right, minimizing risks and preventing future complications.

Trust BDO. We help you implement your ERP system with efficiency, compliance, and business insight.

Contact Us

- Marcela Priori, BSO Partner - Email: mpriori@bdo.com.pe

- José Encalada, BSO Manager - Email: jencalada@bdo.com.pe

- BSO Commercial - Email: atencioncomercial@bdo.com.pe