How to explain Deferred Income Tax to Management?

How to explain Deferred Income Tax to Management?

For such purpose, an expert appraiser was engaged to prepare a technical report to determine the fair value of the investment. Once the report was received, the accountant recorded the necessary accounting entries to update the financial statements. However, to the CEO’s surprise, he noticed the recognition of a new item in the statement of financial position named “Deferred Income Tax Liability”, which he had not anticipated.

How to explain to Management, in a clear and didactic manner, the origin of this liability, which had not appeared in the company’s financial statements prior to the revaluation?

IAS 12 – Income Taxes uses technical terminology that requires interpretation by a professional accountant. For some executives, an initial reading can be complex and difficult to understand.

In this case, it was necessary to clarify the doubts regarding this new liability on the statement of financial position, and to explain that it did not represent a debt that would affect the company’s cash flow. To illustrate this matter more clearly, an example with hypothetical figures, stated in Peruvian Soles (S/) is presented below:

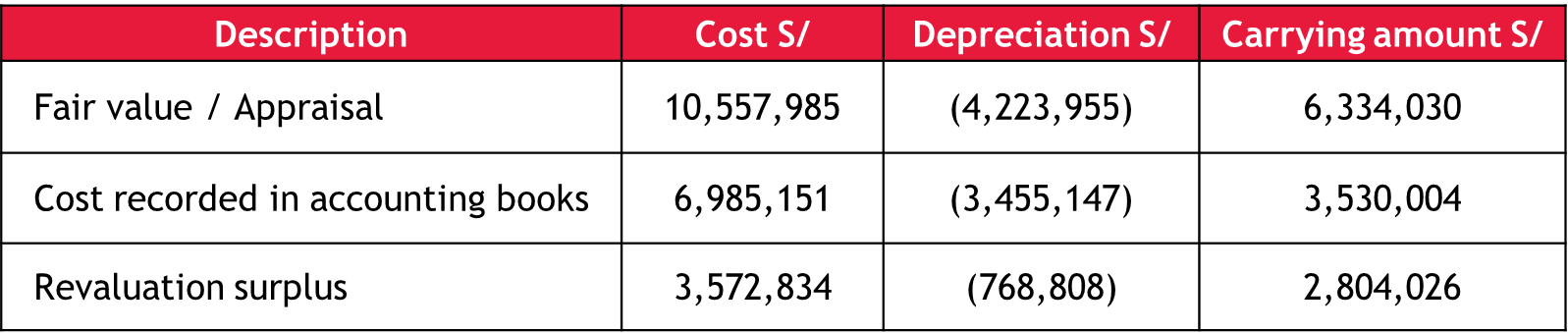

1. Calculation of revaluation surplus and deferred tax:

The application of the revaluation model and the treatment of the resulting excess or surplus is set out in IAS 16 – Property, Plant and Equipment. In this case, the fair value determined by the appraisal amounted to S/ 6,334,030. Consequently, the proportional cost was set at S/ 10,557,985, with an accumulated depreciation of S/ 4,223,9551. As a result, the increase in the carrying amount of the asset was S/ 2,804,026.

2. When a fixed asset —such as a building or machinery—is revaluated, its carrying amount increases to reflect its market value2. This increase is not recognized as income; instead, it is recorded as a reserve within equity. However, tax legislation does not recognize this increase. The difference between the carrying amount of a revalued asset and its tax base is a temporary difference, which gives rise to a liability if the asset’s value exceeds its cost.

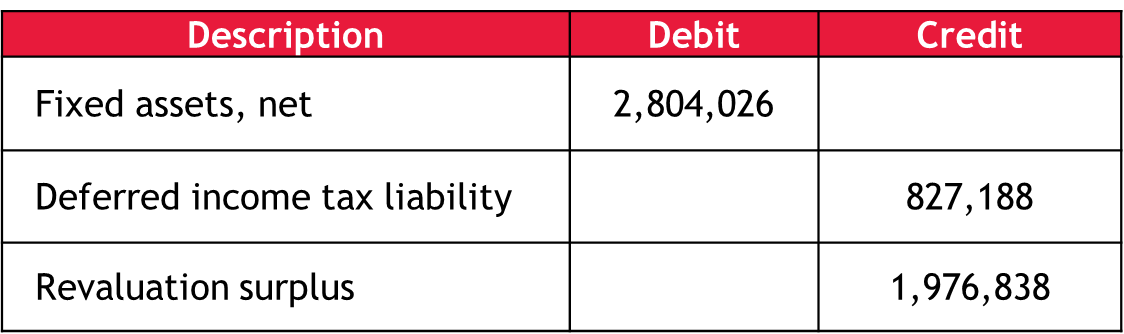

In the years following the revaluation, the depreciation of the revalued asset will be recorded in the accounting books and, given that this expense is not accepted by the Tax Authority, it will be considered as an addition in the calculation of income taxes for a total of S/ 2,804,026. In other words, the company will have an expense that is not recognized for tax purposes, whose tax effect (29.5%) amounts to S/ 827,188. This amount represents the deferred income tax liability.

The summarized manner to book this transaction would be as follows:

It will be essential to explain that the liability for S/ 827,188 will be “reversed” over subsequent periods, without affecting the company’s cash flow. On the other hand, the CEO expected that the revaluation surplus of S/ 2,804,026 could be transferred to distributable profits as the asset was depreciated3. However, by recognizing the deferred income tax liability of S/ 827,188, the net impact on equity was reduced to S/ 1,976,838.

Another aspect to consider is the need to maintain a separate record of the depreciation of revalued fixed assets. This will allow to reasonably determine the non-deductible depreciation expense, and to perform an accurate calculation of not only the company’s income tax payable but also its deferred income tax.

One of the main challenges that we face as accountants is being able to clearly explain the effects of the application of accounting standards and the financial information itself. We hope to have achieved that objective in this case.

In future publications, we will share additional practical case studies that will help illustrate different aspects of accounting standards and their effect on the financial information that Management must take into consideration.

1 “Proportional depreciation reconstruction” method, as set forth in IAS 16.

2 This article focuses on depreciable fixed assets, excluding land, since land is not subject to depreciation. Deferred income tax remains recognized until the asset is sold; and if no sale takes place, it continues to be carried in the Statement of Financial Position.

3 Según la NIC 16 el excedente de revaluación solo será trasladado al rubro de utilidades retenidas de libre disponibilidad para su reparto de dividendos cuando se produzca la baja en cuenta del activo o en la medida que se deprecie. No obstante, en Perú, así como en otras regiones, la Ley General de Sociedades permite la capitalización del excedente de revaluación, lo cual difiere con las normas contables.

Contact Us

- Marcela Priori, BSO Partner - Email: mpriori@bdo.com.pe

- Juan Bautista, BSO Accountant - Email: mbautista@bdo.com.pe

- BSO Commercial - Email: atencioncomercial@bdo.com.pe